To begin your application, a prospective applicant must complete and submit our intake form.

Prospective applicants can access the intake form in one of the following three ways:

- Complete the form online

- Call our office at 515-471-8686 and complete the form over the phone with a staff member’s help

- Stop by our office at 2200 E Euclid Ave., Des Moines, IA 50317 and complete the form with a staff member’s help

After you submit your intake form, you will be added to our interest list.

When an opportunity to complete your application arise, a member of our team will reach out to you to schedule an intake appointment and let you know what you need to bring to that appointment. At that appointment, our team will gather information from you that will determine what homeownership path you are ready for. At the end of that appointment, you’ll have clearly defined next steps for your homeownership journey.

Our Homeownership: Traditional program is currently full through the end of 2025. We expect to begin accepting new participants into this program late in 2024 for homes available beginning in 2026. These plans are subject to change and depend on available funding, home costs, and those currently in the program. We will continue to update those on the interest list on this program’s status.

Between now and late 2024, there may be opportunities for qualified applicants to purchase a home through the Habitat: Direct program. As these opportunities become available, we will contact those on the interest list.

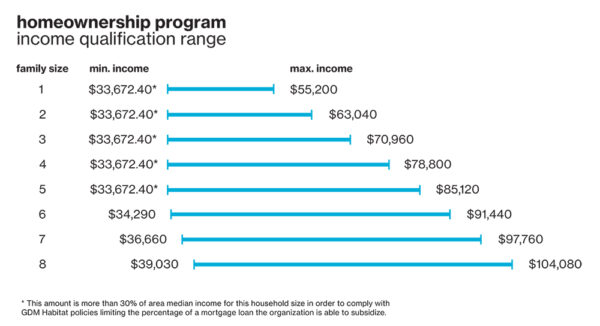

An applicant’s gross household income must be between 30-80% of the area median income for the current year*.

Habitat uses the Area Median Income limits established each year by the United States Department of Housing and Urban Development that take into account family size. The chart below shows the lower and upper limits depending on household size.

After you submit your intake form, you will be added to our waitlist. Currently, the expected wait time on the waitlist is 6-8 weeks. When it is your turn, a member of our staff will contact you to arrange your intake appointment.

Your intake appointment is designed to provide you with a clear path toward homeownership through our homeownership program, Mortgage Ready counseling, or other resources. At the end of that meeting, you will know which program/path you qualify for.

On average it takes about 14 months to complete the program and purchase a Habitat house, but some homebuyers purchase in a shorter amount of time and some take longer.

We evaluate applicants based on three main criteria—Need for Affordable Housing, Ability to Pay, and Willingness to Partner. Contact our team for more information.

Habitat evaluates applicants based on a set list of criteria. Applicants must qualify for the Homeownership Program before meeting the program requirements and qualifying for a mortgage to purchase a house from Habitat.

Yes, we welcome you to reapply if your income and other circumstances have changed since you were declined. Please call us at 515-471-8686 to learn more.

Single people are welcome to apply. We welcome all interested applicants.

It does not count as income in the evaluation of the Ability to Pay criteria, as Habitat cannot reasonably project that that income will continue.

There is no minimum credit score to qualify for the Habitat Homeownership Program. However, the criteria takes into account the amount of debt compared to income, the amount of past due debt, and other credit factors.

The current required down payment is $500 in addition to about $2000-4000 in closing costs paid at the time of purchase. Our team will help you create a savings plan to ensure that you have the required funds available when you purchase your home.

Sweat equity opportunities most regularly available on construction sites and in the Habitat ReStore, but are also occasionally available at special events or in the office.

GDMHFH requires a minimum of 300 hours to purchase a previously owned house and 400 hours for a new construction house.

Depending on if the homebuyer is an applicant or two co-applicants, a set number of hours can be donated by friends/extended family/co-workers.

Additionally, parents can also earn sweat equity for time that others spend watching their children while they are working sweat equity shifts.

The Blueprint to Homeownership classes are specifically designed for the Habitat homebuying experience and cover information that is helpful to set homebuyers up for success in their new roles as homeowners.

That is not an option at this time. Habitat acquires properties and offers these properties with selected house plans to qualified homebuyers.

Where we have properties can vary. Historically we have had properties on the North Side, East Side, South Side, and Drake neighborhood. Occasionally we have had a property outside of these locations. We are always looking for opportunities for new locations to build. People, when eligible (when they are financially ready, and an applicant has completed 25 hours of sweat equity, or 50 hours of sweat equity for two co-applicants), are able to choose from a list of available properties we have at that time.

When you buy a home with GDM Habitat for Humanity, you’ll be able to select a home that fits your family’s size, desired location, and budget. Many GDM Habitat homes are built by our team, while some are existing homes that our team has renovated. You can check out examples of our house plans here:

- 1348 Farmhouse (two-story plans)

- 1158 Ranch (one-story plans)

Habitat houses are a set number of square feet and 3 bedroom plans range from 1,158 to 1,348 finished square feet. The number of bedrooms in a house is determined by Habitat and is based on family size and make-up. Plans with over 3 bedrooms will have additional finished square footage.

Greater Des Moines Habitat for Humanity is not a custom home builder.

We build our house plans to the same structural specifications every time, and provide a basic set of amenities with each house. House features like room size, room location, wall placement, and kitchen arrangement are predetermined by the house plan being built.

We currently provide homebuyers with a limited selection of cosmetic finishes for things like flooring materials, exterior paint color, and countertop color. Habitat also offers new ceiling fans and appliances installed before closing at cost to the buyer. The availability of selections is always changing and while Habitat is constantly working to increase options, we cannot guarantee that choices will be the same for every homebuyer.

Habitat currently offers additional house features compliant with the American Disabilities Act (ADA). If you think this might apply to you or someone in your family, you can contact a Homeownership Program representative with additional questions.

Fair Housing

We Do Business in Accordance with the Federal Fair Housing Law

We are pledged to the letter and spirit of U.S. policy for the achievement of equal housing opportunity throughout the Nation. We encourage and support an affirmative advertising and marketing program in which there are no barriers to obtaining housing because of race, color, religion, sex, handicap, familial status, or national origin.

Interpreters available upon request.

GDM Habitat for Humanity

95 University Ave., Suite 1

Des Moines, Iowa 50314

515-471-8686

Office Hours

Mon. – Fri. 8:00am – 4:00pm

East Euclid ReStore

2200 E. Euclid Ave.

Des Moines, Iowa 50317

515-650-6827

For donations, call 515-309-0224

Store Hours

Mon. – Sat. 9:00am – 6:00pm

Urbandale ReStore

4033 NW Urbandale Dr.

Urbandale, Iowa 50322

515-650-6828

For donations, call 515-309-0224

Store Hours

Mon. – Sat. 9:00am – 6:00pm