The Process

Applying for repairs with the Home Preservation Program is a simple process.

- You complete and submit the application.

- Our team will contact you to discuss your application and take care of any necessary paperwork.

- If you qualify for the program, our team or a qualified third-party contractor will schedule an in-person assessment of your repairs.

- A member of our team or a qualified third-party contractor will visit your home to assess your repair needs and make recommendations for next steps.

- You complete necessary paperwork and sign a homeowner agreement.

- We will schedule your repairs either with our team or a qualified third-party contractor.

- Our team or a qualified third-party contractor will complete your repairs.

- On your own timeline, you repay the deferred, no-interest payment (see below for more info).

Seasonal Pause

Due to holiday interruptions, GDM Habitat for Humanity is pausing the processing of applications. In the meantime, please add your information to our interest list and our team will reach out to you when we resume.

Qualifying for the Program

Two key parts of qualifying for the Home Preservation Program are the applicant’s household income and assessed home value. Both requirements must be met in order to qualify. Other qualifications may apply – contact our team at repairs@gdmhabitat.org to learn more.

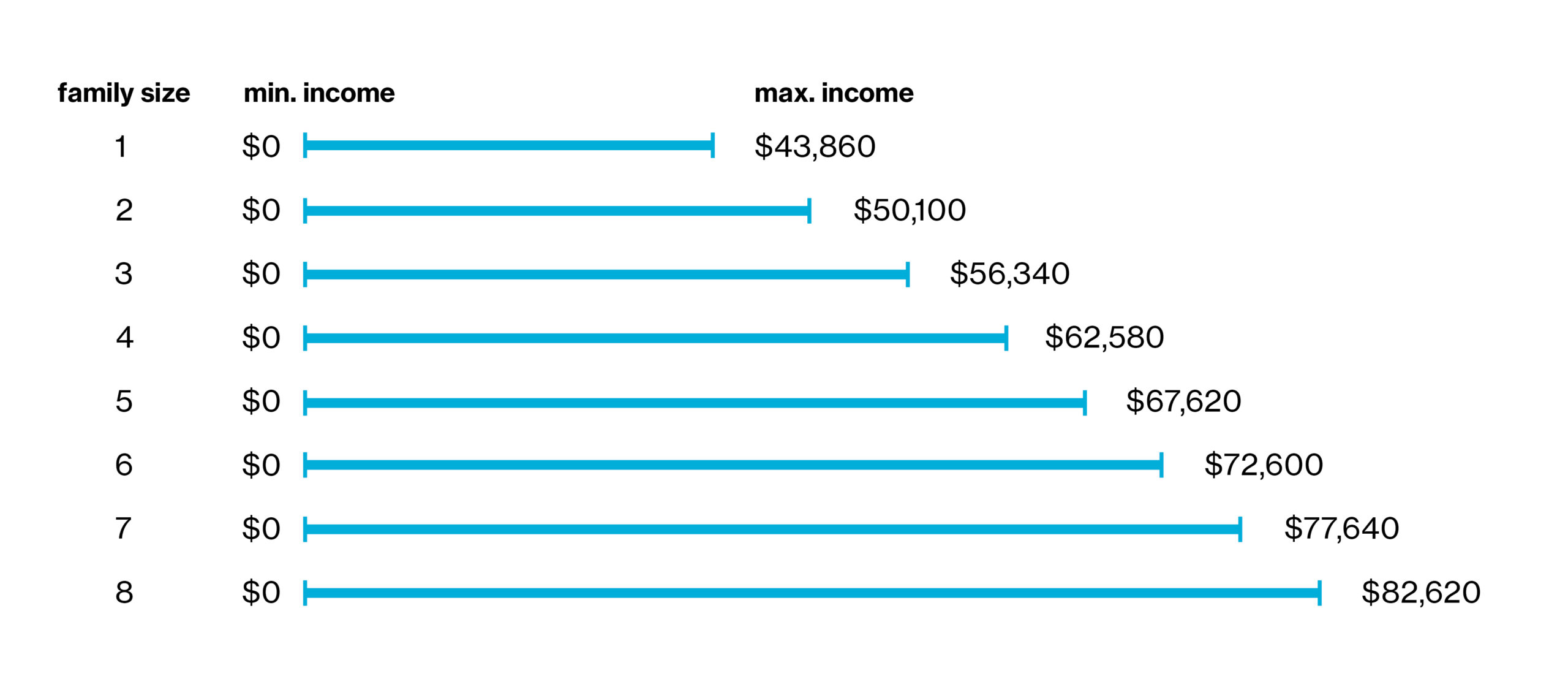

Income qualifications

Home value qualifications

In order to qualify for the Home Preservation Program, the applicants’ gross household income must be no more than 60 percent of the Area Median Income for the number of people occupying the home. The chart above shows the maximum income for each household size. Seniors and veterans may qualify for a higher income limit.

In order to qualify for the Home Preservation Program, the applicants’ assessed home value must be no more than $225,000. You can find your home’s assessed value by visiting your county assessor’s website (Polk County, Dallas County, Jasper County) and searching for your address.

Rural property in Dallas or Jasper County may be assessed differently. Contact our team at repairs@gdmhabitat.org to learn more.

Let your home pay for its own repairs

Habitat for Humanity’s home preservation program can help you make the repairs your home needs now, making expensive upkeep like a furnace replacement, new windows, roof repair, or accessibility ramp affordable. Our deferred, no-interest payment** uses the growth in your home’s value over time to cover the cost of your repair when you eventually sell your house. Using your home’s equity, you can cover the cost of your repair on your own time, even 20 years later – with no interest and no money out of your pocket.

How we make it happen

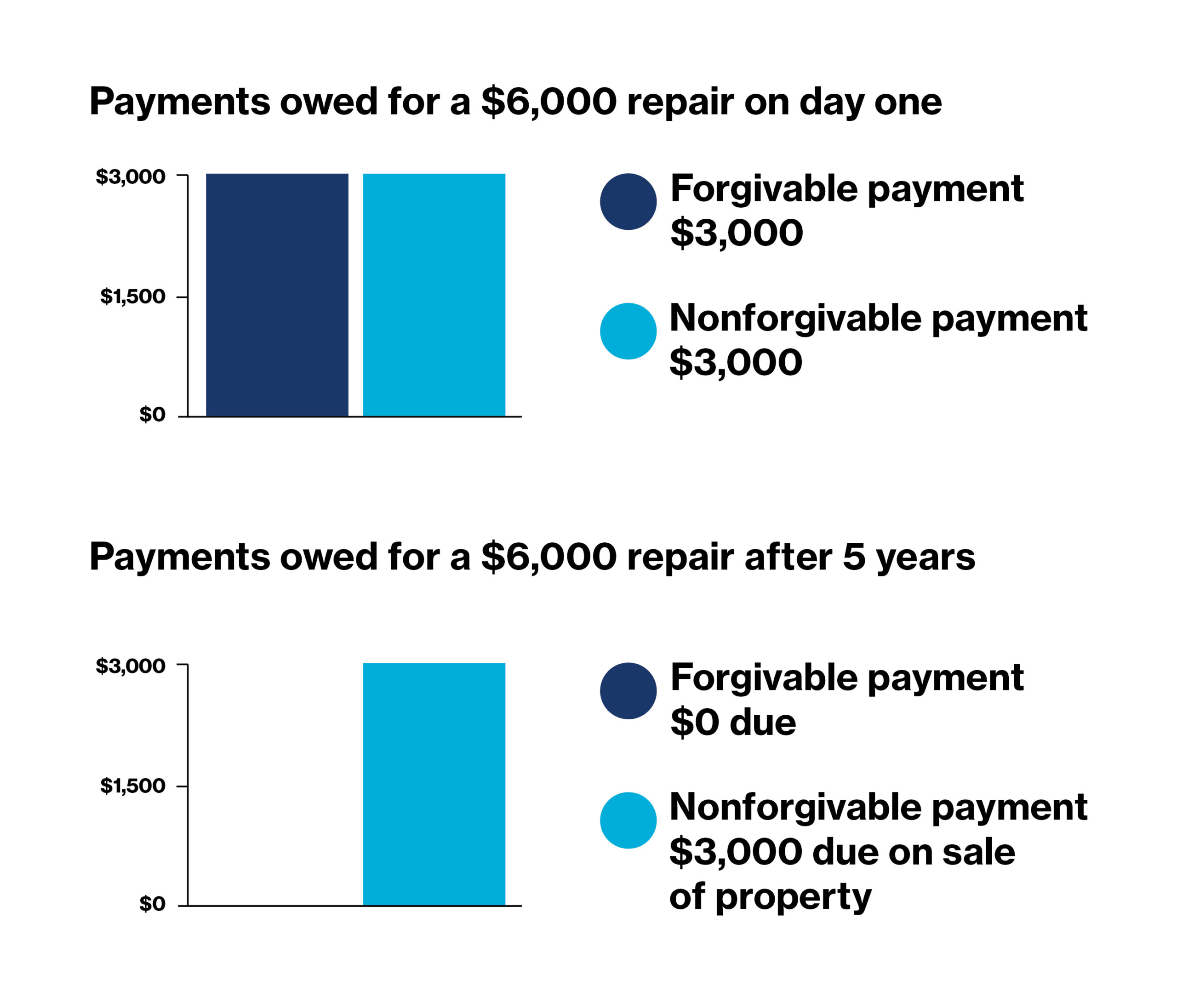

To illustrate how our deferred, no-interest payment works, we’ll look at a hypothetical repair that costs a total of $6,000 to complete.

Every repair is different. Our team will work with you to ensure that you understand the costs of your repair.

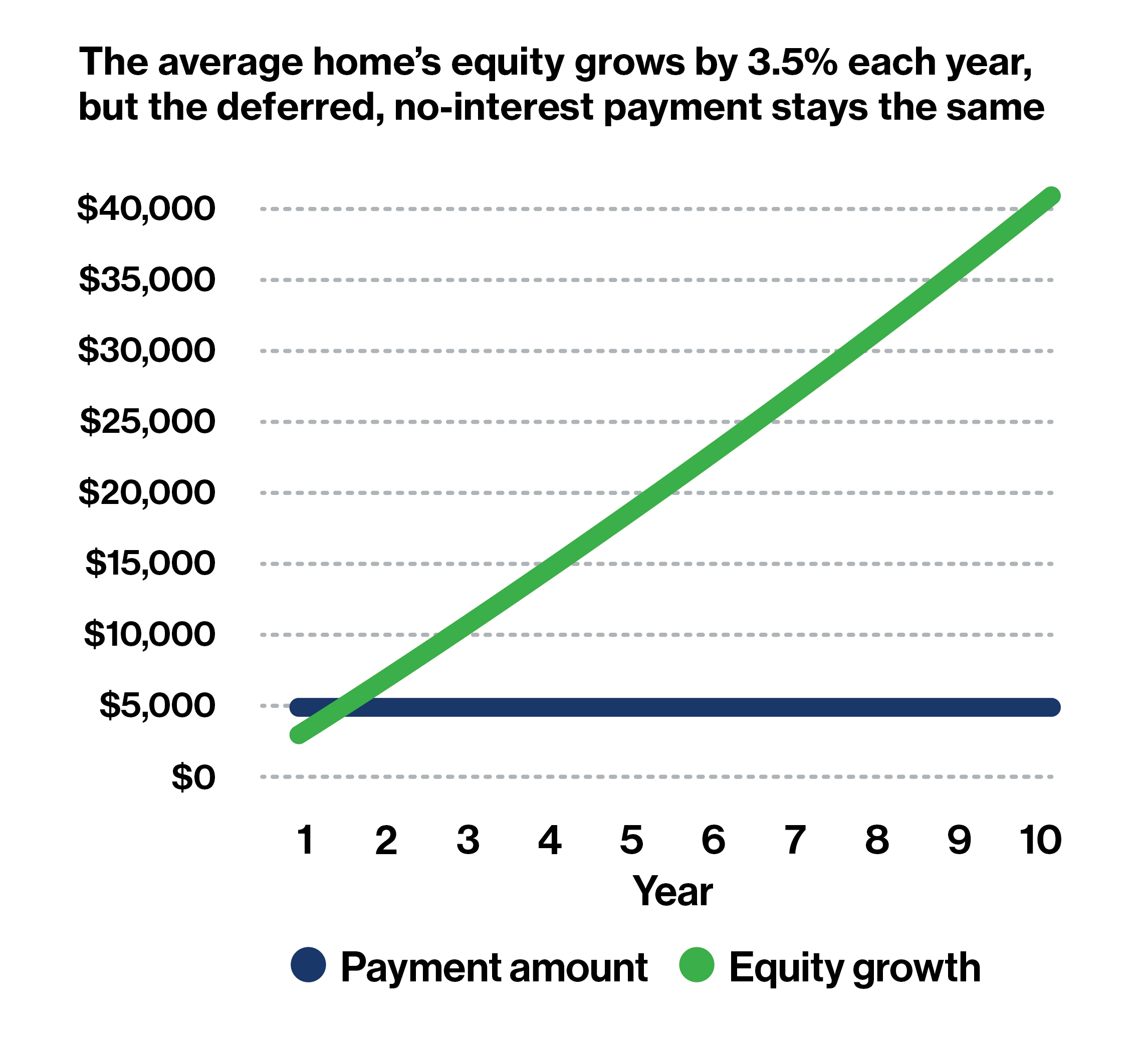

This chart shows an example of equity growth for a home whose value starts at $100,000 and grows at the average rate. Home equity is not guaranteed to grow and can be impacted by a home’s state of repair.

In this case, the home’s equity grows over 10 years by nearly $40,000. The deferred, no-interest payment stays at a flat, $5,000. If this homeowner sold their home at the end of these 10 years, they would be able to complete their payment and still benefit from nearly $35,000 in equity.

These charts show our example of a $6,000 repair. The first chart shows the payments on day one: each payment owed is $3,000, but one is forgivable over 5 years. The second chart shows the payments owed after 5 years. Just one $3,000 payment is owed, while the other has been forgiven and is no longer owed! The remaining $3,000 payment can be paid when you sell your property or any time before that point.

What if you want to pay it off after 3 years? Part of the forgivable payment is forgiven each month, so you would only need to pay off what remains. After 3 years, just $1,200 would be owed on the forgivable payment.

Meet the Home Preservation Program team

Jeff Vieth

Construction Superintendent

Jon Plummer

Intake Coordinator

Becky Lodestein

Intake Associate

Don Burton

Project Manager

Tom Wood

Construction Manager

Tal Roth

Construction Manager